What is Cash Flow?

Cash flow is the total amount of money entering and leaving your business over a period of time, especially affecting liquidity.

It’s one of the strongest factors that determine the survival of any business – ideal or not. In fact, one way to tell if your business is at a high or low risk of failing is by looking at the state of your cash flow.

That’s why for all the clients I’ve worked with through the years, this is one of the first things I look at very closely.

Usually, I ask them the following questions:

- How do they manage their finances?

- Do they have a system in place for managing cash flow?

More often than not, there’s not much of a system. That’s when I show them the five tools they can use to establish cash flow control.

How Do You Create Cash Flow Control?

If you’re dissatisfied with your current cash flow situation, and if you always stress about paying your bills, then you need to implement a cash flow management system. To gain 100% control of your cash flow, there are five things that you need to do:

- Utilize Cash-on-Hand versus Bills.

- Design your business to operate in a cashflow positive manner

- Establish an effective cash flow allocation system

- Allocate cash for the three tenses of time

- Save cash reserves good for 12 months

Read further to learn more about the importance of each tool and to get a brief idea of how to implement each within your business.

Implement Cash-on-Hand versus Bills

Implementing Cash on Hand versus Bills enables you to get an accurate insight into the cash you have at any given moment. If your Ideal Scene involves sitting by the beach away from the business most of the time, this system will help you get a quick and accurate snapshot of your company’s financial health. This results in better peace of mind and a high level of financial certainty.

The way it works is simple. All you need to do is ask the question: If you were to turn the business off, how much cash would you have left? To answer this, let’s assume that anyone who owes you money is not going to give you money.

The only things that you can count as real cash are:

- Cash-On-Hand: The money inside your bank accounts, and the money you can access.

- Bills: The money you owe to anyone. This includes GST and sales tax.

For example, your cash on hand might be $150,000. You might owe $300,000 which results in a negative “Cash-In-Hand-Bills Figure” which is -$150,000. This is alarming.

This powerful process lets you immediately understand your cash position, whether it’s negative or positive. If you’re someone looking to extract yourself from the business, this simple exercise becomes crucial in giving you a good picture of your financial health.

Operate in a Cash Flow Positive Manner

Having a positive cash flow means more money should come into your business than flowing out. When it comes to determining a business’s performance, it’s just as important as profit. Here’s why.

Despite a high-profit margin, if cash flow is low, pressures on your business will still exist. For example, three decades ago, I owned a manufacturing company. Despite being a multi-million dollar company, its business model was entangled with too many IOUs and delayed payments that we would simply get ghosted for projects already delivered.

We typically had a small number of debtors who in total owed us over $1 million. This was far from a cashflow positive business which eventually resulted in bankruptcy.

That’s why today, I design my business to operate in a cash flow-positive manner. To do this, I’ve set up the following approaches:

- Set up payment terms that would support a cash-flow positive business

- Ensure that, if several debtors failed to pay, it would not impact the viability of the business

- Set clear credit terms that, if exceeded, will not be extended regardless of the promise of more business

- Wherever possible arrange back-to-back payment flow with larger suppliers and contractors

Establish an Effective Cash Flow Allocation System

It’s important to understand that money likes to move and flow, instead of staying static and still. If you want to effectively manage cash, it is imperative to integrate this behavior into the management of your cash flow.

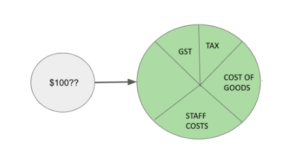

One way of doing this is by establishing an effective cash flow allocation system. This system is rooted in the principle that all cash that flows in already has a specific purpose. For example, when a business earns $100, it’s not just $100. Instead, it’s allocated to different areas of the business as shown below.

This approach enables you to allocate money to critical areas instead of simply spending on what’s making the most noise.

Allocate Cash for the Three Tenses of Time

To run a profitable and sustainable business, it’s important to allocate cash for the past, present, and future. Keeping these 3 flows of cash balanced will help you take the stress out of managing cash and ensures all critical areas of your business are covered.

- The Past – This includes debt and loans. This is the first part you need to take care of. Or else, you’ll get people ringing you up and you’ll get stressed from creditors and suppliers.

- The Present – This includes expenses like staff costs and other operating expenses.

- The Future – This includes expenses like the Goods & Services tax, expansion costs, and cash reserves.

The challenge in cash management is typically the tension between these areas, which is what inevitably leads to a lack of control. Most of the time, the future has no scope to allocate.

It’s impossible to run a sustainable business without also allocating for the “future” component. That is why we have the next approach which is to save cash reserves good for 12 months.

Save Cash Reserves Good for 12 Months

It’s crucial to have enough cash to run your business for 6-12 months with little to no revenue. Personally, I’d have cash reserves for up to 12 months, but it all depends on your ideal level or risk.

Having been in a situation where I’ve lost control of my cash flow that resulted in my first major business failing 3 decades ago, I’ve learned the importance of cash reserves. They give you certainty. They provide the resources to adapt when the unpredictable happens, such as COVID-19 or any upcoming recessions.

To implement this, you’ll need a high level of discipline and understanding of how important cash reserves are. Simply set aside cash that’ll cover 12 months of business operations assuming that there will be no revenue.

Another approach is to get money when you don’t need it. In my three decades in the business, I’ve learned that when I need cash, it’s hard to get it. Banks refuse to give loans, and nobody’s willing to invest. The reason? Nobody wants to transfer your risk to themselves.

Thus, you must borrow or save money in advance and call it your “rainy day” fund. This approach will not only give you peace of mind. It will also help you adapt when something unexpected takes place such as an economic downturn or pandemic.

How Ideal Is Your Business’ Cashflow?

Cashflow is one of the main key challenges for many business owners. Lack of cash and cash flow is also one of the main reasons why businesses get into strife.

To assess how ideal your business is, look at your current business model and the way money flows in and out. Does your current cash flow operate in a way that’s ideal?

To further evaluate this, ask the following questions:

- Do you fail to operate in a cashflow-positive manner?

- Do people and companies owe your business money for long periods?

- Can debtors impact the viability of your business if they fail to pay?

- Do you lack confidence in your cash position if ever unexpected events take place like COVID-19?

- Do you lack instant access to reserves and backup cash in case of emergencies?

- Do you lack a structured framework for managing your cash?

Once you’ve reflected upon these questions, rate how ideal your cash flow is from 1 – 10. Then ask yourself, what changes can you implement to increase the rating and improve your cash flow position?

If you want to follow along with the story of how I redesigned my previous business into an ideal one that allowed me to live the quality of life I wanted, sign up for our newsletter: https://idealbusiness.invizbiz.com/newsletter